US Tax Filing & Payment Deadline 2020

The treasury department and IRS are extending the deadline for tax filing due to COVID-19. It comes as a relief for businesses and other working individuals who have suffered deeply due to this outbreak. Pushing back the deadline gives more time to file the taxes but the IRS urges taxpayers to have their refund owed by IRS to file without wasting any time. In 2020 the deadline was extended from April 15 to July 15 due to COVID-19. But this year’s deadline is April 15, 2021, and the IRS is arguing people file their tax returns before the due date.

How to File Extension

You need to spend a lot of time and money on tax filing. Aside from procrastination and neglect, the majority of the time, folks fail to file their tax returns before April 15 either because they are caught up in their hectic schedule or awaiting all of the necessary tax documents.

Recognizing this inevitable errand, the IRS allows for an extended period of 6 months, i.e. it allows for postponing the deadline to file tax returns from April 15 to October 15. The deadline for filing your taxes in 2021 is still April 15, 2021.

The deadline includes the due day which is April 15 and taxes are due every year. There is still a chance that in this ongoing pandemic the date for filing taxes may extend. But for now, it is April 15. So, you need to prepare all your documents before the due date.

This way people that are too busy with their private or professional commitments can get some extra time to gather all their tax documents, review them completely and come up with a tax return that’s in their best financial interests. One must file a tax extension before April 15 to get it and it is really straightforward and easy to understand how to file a tax extension. This article will narrow down the things one must do in five simple steps to understand how to file a tax extension better.

- Before understanding how to file a tax extension, it’s advisable you realize the complications of tax extension as well as the limitations it includes. An IRS tax extension basically allows one to postpone the filing of tax returns for 6 months but does not allow any extension on tax payments. If you owe taxes to the authorities, then you are liable to cover it up on or before April 15. Thus, it would not be a wise move if you file for an extension hoping you could postpone the obligations.

- Second, even though an extension is provided until October 15, the last date to file an extension remains April 15. As long as you fail to do this, you must pay the penalties for late filing, which could be 5% of the unpaid taxes to a maximum of 25 percent.

- Additionally, if you are unable to pay the expected tax sum before April 15, the failure-to-pay penalty gets added to the failure-to-file penalty. Generally, failure-to-file punishment is greater compared to the failure-to-pay penalty. Therefore, no matter how active you are, it is necessary to file a tax extension before April 15 to avoid penalties.

The first thing to do in this regard is to get your hands on form 4868 if you’re filing as a person and if you are a business owner then you need to get the 7004 form. These forms may be obtained online, either on the IRS website or free e-file offering sites.

Your name, contact information, and social security number are the only things you would need to complete the filing. Prefer e-filing if you would like it to be done over 5 to 6 minutes. Yes, tax extension is truly that easy!

- Don’t forget to make any entry mistakes or offer wrong information as this might be the only possible motive for the IRS to disapprove your plea to extend. The IRS generally approves of an extension, regardless of what the reason. One of the advantages of e-filing is that you can track the status of your program and also receive a confirmation email once you receive the approval.

- Lastly, with the time provided, gather all the documents you’d need to do research and try filing a tax return that’s as precise as possible so that you have to pay the least taxes and get fantastic deals on tax refunds too.

All these are the five simple points you must know about how to file a tax extension. Go through additional information about how to file a tax extension on the IRS website and if you’re almost ready with your tax returns before April 15, rethink the notion of extending the deadline, even since it is not in any way necessary in this circumstance.

How soon can you file taxes?

The due date is April 15, 2021, but you can file your taxes anywhere between January 15 to Feb 1, 2021. IRS will accept your submission.

When are taxes due if I file an extension?

If your extension is approved you have until October 15, 2021, during this time you can pay any penalties and fine.

So, if you think you need extensions then you need to start working on it now. This way you will have a lot of time and you can fix all the mistakes and errors in the application. It will also give you time to prepare for your forms and documents ahead of time so you don’t miss anything. It is a good way to ensure you get the extension on your deadline.

Last date for filing the income tax return

In October, it was further extended to December 31, 2020. For taxpayers whose accounts need to be audited, the ITR filing deadline has been extended for two more months till January 31, 2021.

The filing income tax return date is December 31, 2020. However, for the people who are being audited by the IRS, the deadline has been extended till January 31, 2021. Taxpayers can file ITR online through e-filing

Conclusion

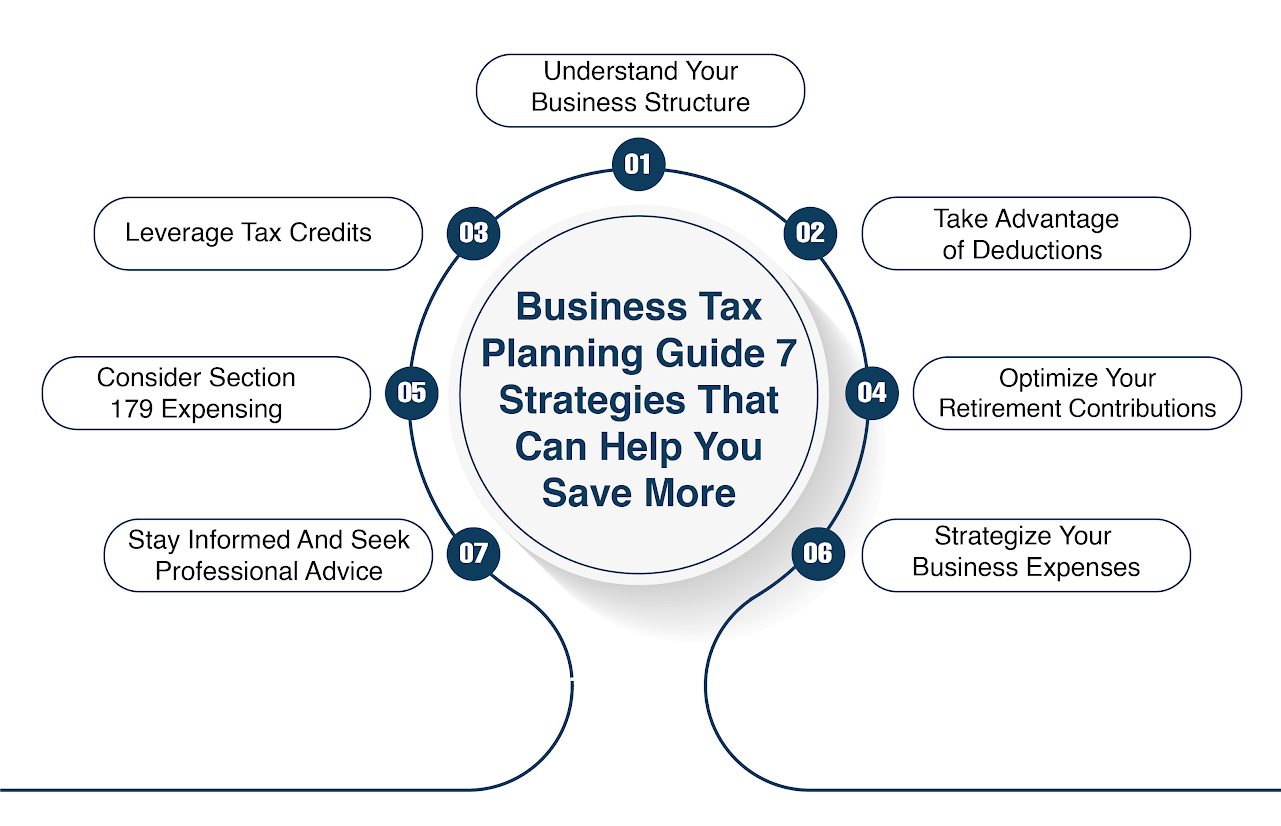

Time is running and you have to prepare every relevant document. So, don’t waste and start preparing if you are unable to do the task yourself then you can get the help of a CPA firm or tax professional that can help to smoothen things for you.